The incident of Wang Shaohua, the chairman of Guodu Securities, has not been conclusive. However, there are a number of clues looming at the moment. "Obviously, there is more than one chairman who loses the link, and the absence of corporate governance in Guodu Securities and the hidden dangers of insiders control."

Let us first review the incident of Wang Shaohua’s loss of association:

schedule

On May 27, Wang Shaohua, the chairman of the former China Credit Trust and the chairman of Guodu Securities, was taken away by the judicial authorities.

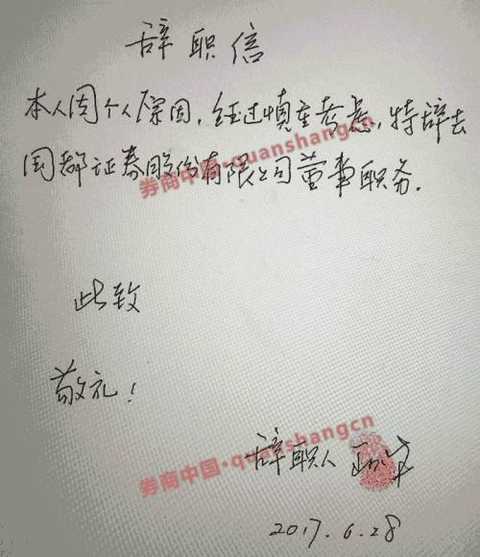

On June 28, Wang Shaohua, who was detained, wrote a "resignation letter" and handprinted it, saying that "I personally resigned from the position of director of Guodu Securities after careful consideration."

On July 21, Guodu Securities announced that “Wang Shaohua lost his connection†and issued the “Announcement that the company’s chairman could not perform his duties normallyâ€.

⊙ On July 24th, Guodu Securities held a board of directors, convened and presided over by the chairman of the board of directors, Weng Zhenjie, who was elected by more than half of the directors.

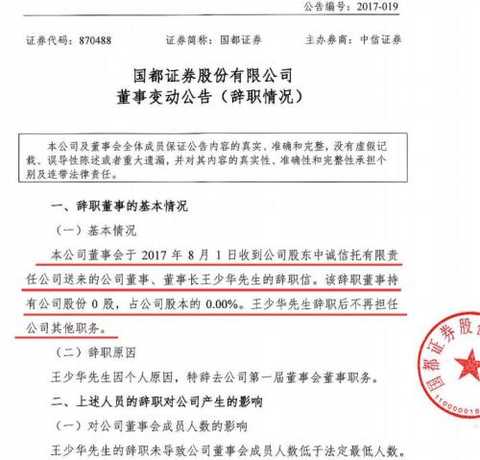

On August 3, Guodu Securities issued the “Director Change Company (Resignation)â€, stating that the board of directors received the resignation letter from Wang Shaohua, and the director Weng Zhenjie acted as the chairman of the board within the statutory time limit.

a late resignation letter

The above-mentioned Wang Shaohua's handwritten resignation letter was exclusively disclosed by the authoritative and informed person to the brokerage Chinese reporter.

The person familiar with the matter also revealed that Wang Shaohua handwritten his resignation letter on June 28, and Guodu Securities announced on July 21 that Wang Shaohua lost his connection. On August 3, he announced that Wang Shaohua’s resignation letter was sent by Zhongxin Trust. During the month, members of the board of directors of Guodu Securities were basically “uninformedâ€.

When did China Trustworthy receive the resignation letter from Wang Shaohua, if it had already received the resignation letter, why was it not submitted to the board of directors of Guodu Securities until August 1? According to the judgment of the industry, one possibility is that China Credit Trust has not obtained this resignation letter before, and it is not known at which link the letter was put on hold.

According to the above-mentioned insiders, Guodu Securities' equity is extremely scattered, and most of the shareholders are industrial capital that does not interfere with specific business management. Wang Shaohua, 61, basically does not go to Guodu Securities. General Manager of Guodu Securities controls Guodu Securities, the company's management decision Basically, I am always talking about it.

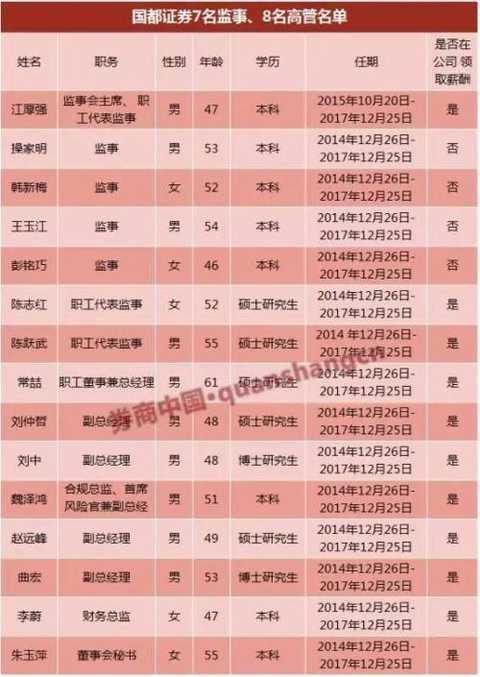

Unexpectedly, during the period of great changes in Guodu Securities, General Manager Chang Hao chose to leave the country. It is understood that before the return of Changyu in mid-August, Wei Zehong, the director of compliance, chief risk officer and deputy general manager of Guodu Securities, was temporarily responsible for the operation and management of Guodu Securities.

What is the reason behind the resignation letter?

On August 3, Guodu Securities announced that “the company’s board of directors received the resignation letter from Wang Shaohua, the company’s director and chairman of the company’s shareholder Zhongxin Trustee Co., Ltd. on August 1. The resigned director holds 0 shares of the company. , accounting for 0.00% of the company's share capital. Wang Shaohua will no longer hold other positions in the company after resigning."

The insider disclosed to the brokerage Chinese reporter that the office of the board of directors of Guodu Securities received the resignation letter of Wang Shaohua from Zhongxin Trust at 10:15 am on August 1. Prior to this, Zhongxin Trustee has always said that he did not receive Wang Shaohua's resignation letter, never seen and could not get it.

The resignation letter of Wang Shaohua, which was received by the reporter, was completed by Wang Shaohua with a black carbon pen. He said that “I personally, after careful consideration, I resigned from the directorship of Guodu Securities Co., Ltd.†This 30-word resignation letter The time for the payment was June 28, 2017. The resignee Wang Shaohua signed a handprint, not the official seal of Wang Shaohua.

It should be noted that this resignation letter was written by Wang Shaohua after being detained by the judicial department on May 27. Zhongxin Trust said that he did not see the resignation letter before the time he arrived at the board of directors.

It is also worth noting that Zhongxin Trust has offered to replace Wang Shaohua in late July, nominating new directors to enter the board of directors of Guodu Securities, and other board members of Guodu Securities proposed “requires Wang Shaohua’s written resignation letterâ€. "I have never seen it before" to inform the board.

In the view of the above-mentioned insiders, on June 28, Wang Shaohua wrote a resignation letter. By August 1st, members of the board of directors of Guodu Securities saw the resignation letter. The delay or possibility of concealment in the middle is worrying. The “performance effect†of the securities board is even more worrying.

According to the 2017 semi-annual financial statements (unaudited) announced by Guodu Securities on July 18, Guodu Securities achieved operating income of 713 million yuan and net profit of 344 million yuan in the first half of this year. The legal representative office of this financial report still covers the special seal of Wang Shaohua.

General Manager of Guodu Securities, Chang Hao, went abroad for leave

In a securities company that does not have a controlling shareholder or actual controller, the management power is often large. The equity of Guodu Securities is extremely scattered, and most of the shareholders are industrial capital that does not interfere with specific management and management equity. The hidden dangers of “inside people control†of Guodu Securities have already emerged.

The brokerage Chinese reporter learned from the authoritative and insiders that during Wang Shaohua's performance in Guodu Securities, he was born in the same year as Wang Shaohua, who also experienced the same life as an educated youth. In the same year, he was the general manager of Guodu Securities, who was studying at the Liaoning University of Finance and Economics (now Dongbei University of Finance and Economics). He is the actual "steer" and was once the legal representative of Guodu Securities. Under the tremendous changes in the personnel of Guodu Securities, Chang Hao has gone abroad to leave the country. It is a surprise.

According to insiders of Guodu Securities, Wang Shaohua, who is the chairman of Guodu Securities and during the period of receiving remuneration from Guodu Securities, rarely went to Guodu Securities. “Basically not going to Guodu Securities, it is a complete sheep management. The company’s management decision is basically one person. I have the final say."

It is worth mentioning that Chang Hao is 61 years old and “has been in over-serviceâ€. Guodu Securities public transfer instructions show that Chang Hao was born in April 1956, from July 1975 to February 1978 in Shuanghai, Buhai Township, Dehui County, Jilin Province; from February 1978 to January 1982 in Liaoning The Finance and Finance Department of the School of Finance and Economics (now Dongbei University of Finance and Economics) participates in undergraduate studies.

From January 1997 to December 2001, Chang Hao served as deputy general manager and general manager of China Fortune Trust's headquarters. Chang Hao participated in the preparation work of Guodu Securities. In December 2001, he served as the deputy general manager of Guodu Securities. The then general manager was Wang Shaohua. Since January 2010, Chang Hao has been promoted from the deputy general manager of Guodu Securities to the general manager and director of the board of directors.

"Now is the most difficult time for Guodu Securities. First, the external regulatory environment is becoming stricter, regulatory policies are adjusted, and de-leverage and de-channel requirements are required. Financial institutions need to return to their main business. At this time, Guodu Securities is facing personnel. The problem will inevitably bring some impact. Business development is the most difficult time, the company's directors basically do not care." The informed source told reporters that the governance structure of Guodu Securities is formally and rationally designed, but the actual role is not optimistic. .

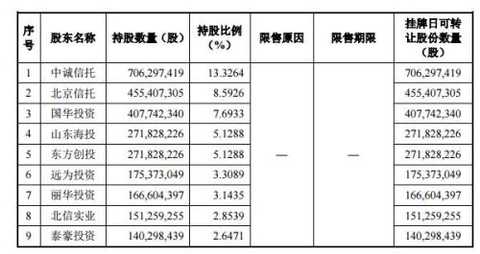

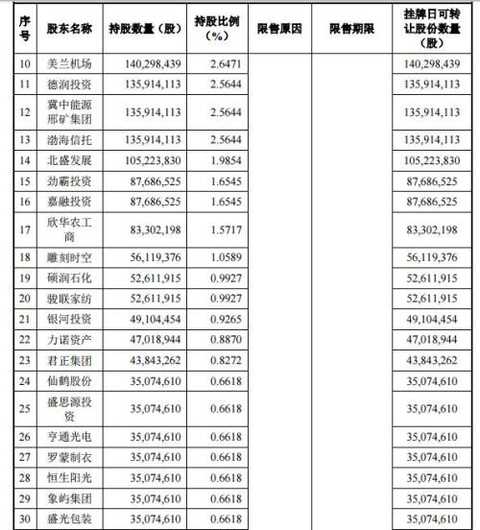

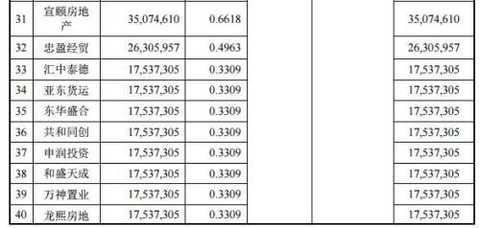

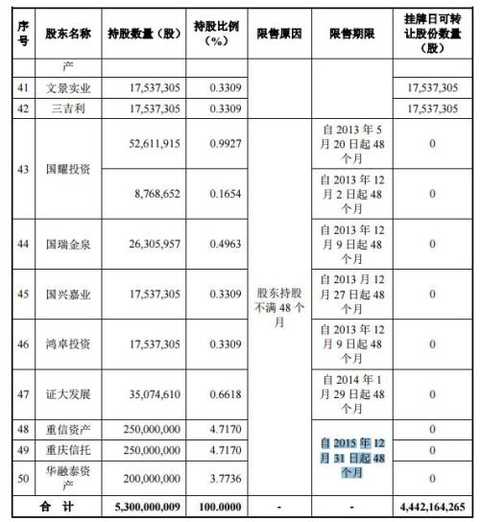

It is understood that Guodu Securities has 50 legal person shareholders. Except for the assets of Chongqing Trust, Chongqing Trust and Huarongtai, the other 47 shareholders are the promoters of Guodu Securities Co., Ltd. Among the promoters' shareholders, Guoyao Investment, Guorui Jinquan, Guoxing Jiaye, Hongzhuo Investment and Zhengda Development have been in the restricted period after the company has been established for one year due to the short holding period; the company's other shareholders The company's equity may not be transferred within 48 months from the date of the holding of the company's assets, such as Chongqing Trust and Huarongtai Assets.

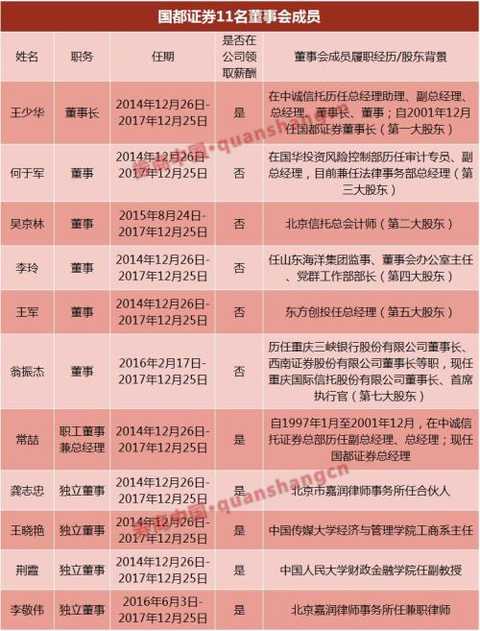

Weng Zhenjie, Chairman of the Board of Directors of Guodu Securities

The family can't be without a day, and the "dead person" of Guodu Securities and the head of Chongqing Trust, Weng Zhenjie, "have been on the verge of death." The brokerage China has reported on July 28th: ​​"The chairman of the board of directors of Guodu Securities is in place. The current head of the Chongqing Trust was originally "the old man", and he took charge of the acquisition of the country by Southwest Securities five years ago.

Guodu Securities’ announcement on August 3 was made clear for the first time: “The 12th meeting of the first board of directors held by Guodu Securities on July 24, 2017, agreed that more than half of the directors elected by Weng Zhenjie will act as the chairman of the board within the statutory time limit. To the date the board of directors elects the chairman."

Weng Zhenjie, 55, is the seventh largest shareholder of Guodu Securities (holding 4.771%). The current chairman and CEO of Chongqing Trust. On February 17, 2016, Weng Zhenjie, nominated by Chongqing Trust, entered the board of directors of Guodu Securities and became a new director. Before Guodu Securities did not elect a new chairman, Weng Zhenjie will serve as the chairman of the board of directors of Guodu Securities.

According to Article 49 of the Measures for the Supervision and Administration of Qualifications of Directors, Supervisors and Senior Management of Securities Companies by the China Securities Regulatory Commission:

When the chairman and general manager of a securities company are unable to perform their duties or are absent, the company may, in accordance with the provisions of the company's articles of association, temporarily determine the personnel who meet the requirements of Article 8 to perform their duties, and to the China Securities Regulatory Commission and registration within 3 days from the date of the decision. Reported by the local agency.

If the person determined by the company does not meet the requirements, the CSRC and the relevant dispatched agency may order the company to decide on a separate period to perform the duties of the person on duty, and order the original person to perform the duties for the person performing the duties.

The time for performing the duties on behalf of the person shall not exceed six months. The company shall select and hire qualified personnel to serve as the chairman and general manager within 6 months.

This means that within the next six months, Guodu Securities must elect a new chairman. For the new chairman of Guodu Securities, the reporter learned that among the top ten shareholders of Guodu Securities, three or four shareholders have intentionally elected their nominee directors to become the chairman of the board of directors. The first major shareholder Zhongxin Trustee “is very concerned about the chairman’s seat. I am sure I have to fight for it." Next week, Guodu Securities will hold a board meeting.

TR90 Glasses Frames,Anti Blue Lens Frame,Anti Blue Glasses,TR90 Blue Light Glasses

WENZHOU BOCHENG EYEWEAR CO.,LTD , https://www.bocheyewear.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)